GN-99955-CG 2009-2026 free printable template

Show details

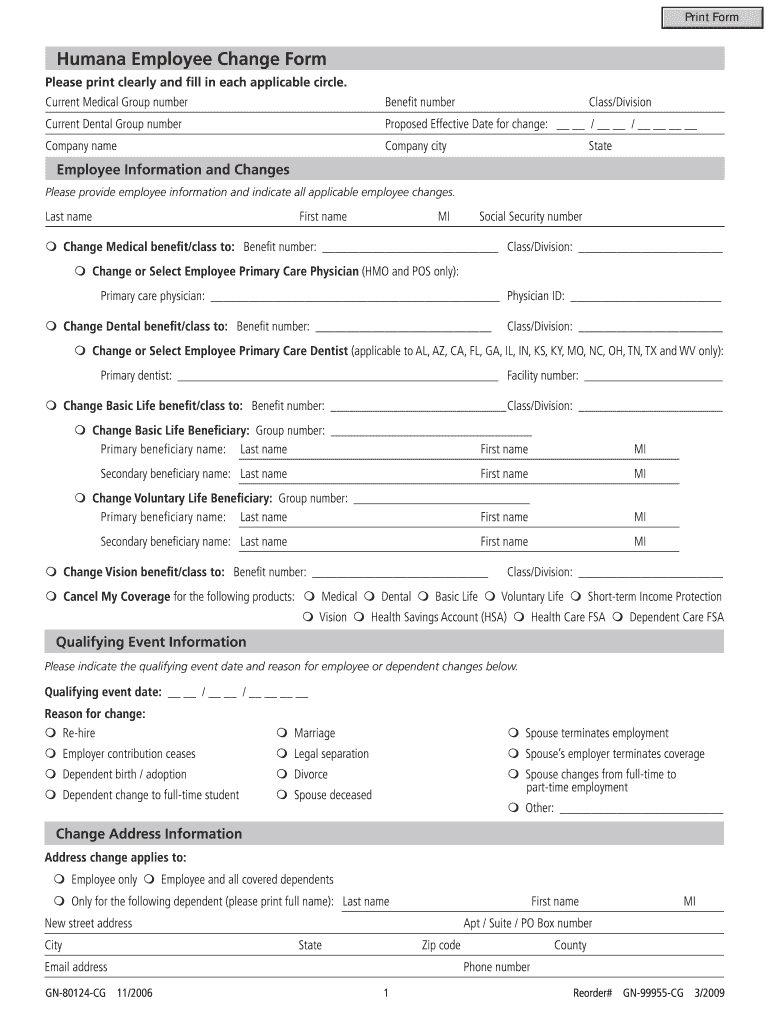

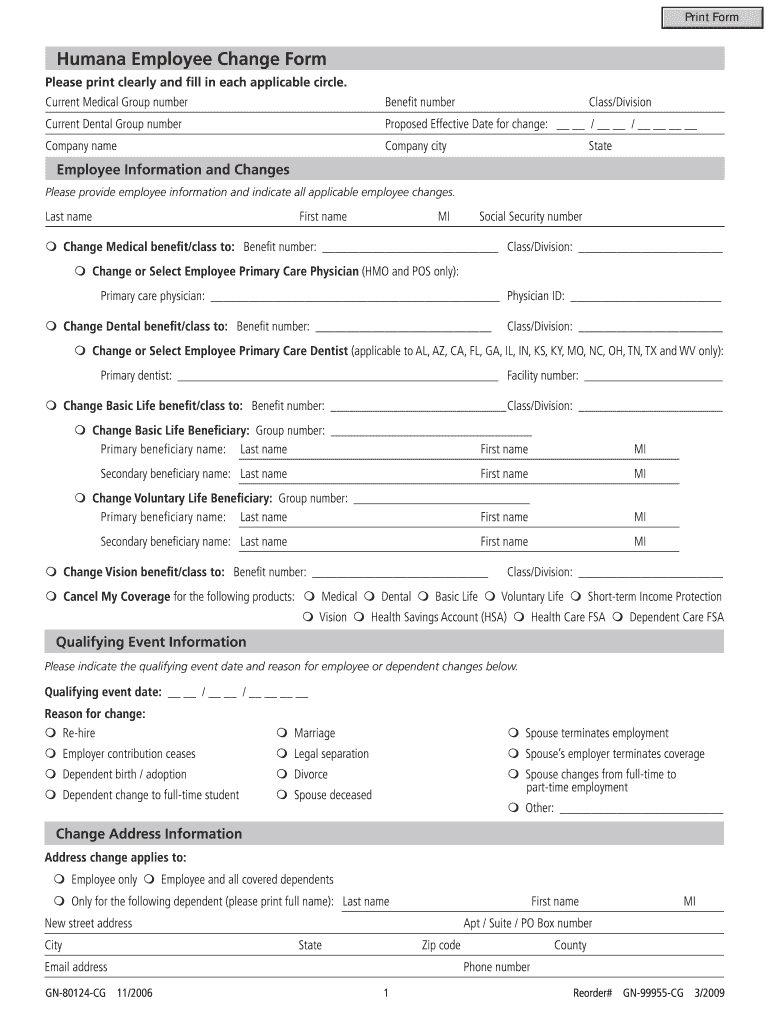

Print Form Human Employee Change Form Please print clearly and fill in each applicable circle. Current Medical Group number Benefit number Class/Division Current Dental Group number Proposed Effective

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign humana hr4u form

Edit your humana ein form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your humana w2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit workday humana online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit hr4u humana form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out my apps form

How to fill out GN-99955-CG

01

Obtain the GN-99955-CG form from the designated authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information in the designated fields, including your name, address, and contact details.

04

Provide any required identification or references, as specified in the form instructions.

05

Complete the section regarding the purpose of submitting the form, ensuring all necessary details are included.

06

Review the form to check for any errors or missing information.

07

Sign and date the form where required.

08

Submit the form following the specified submission guidelines (mail, in-person, etc.).

Who needs GN-99955-CG?

01

Individuals or organizations that need to formalize a specific request or application related to the GN-99955-CG process.

02

People seeking to comply with regulations or requirements that necessitate the use of the GN-99955-CG form.

Fill

humana workday

: Try Risk Free

People Also Ask about workday login humana

How many Humana employees are there?

Humana | 2022 Fortune 500 | Fortune.

What is Humana PTO?

Humana's PTO and Vacation policy typically gives 20-30 days off a year with 75% of employees expected to be work free while out of office. Paid Time Off is Humana's most important benefit besides Healthcare when ranked by employees, with 63% of employees saying it is the most important benefit.

Is Humana a Fortune 50 company?

Under an agreement approved unanimously by both companies' boards of directors, Aetna, the larger of the two insurers, bought Humana for $230 a share, the companies said. Aetna's shareholders would own approximately 74 percent of the combined company and Humana's shareholders would own approximately 26 percent.

Who bought out Humana?

In July 2015, Aetna announced that it would acquire Humana for $37 billion in cash and stock (approximately $230 a share at that time).

How many people are employed by Humana?

Humana has 48,700 employees.Humana Diversity. CEOBruce Dale BroussardExecutives Who Are Women45%Employees Who Are Minorities36%Executives Who Are Minorities42%5 more rows • Feb 6, 2023

What is the Humana employee attendance policy?

Attendance rates among Humana's employees will be at least 95% over time.

How do I get my W2 from Humana?

Humana Help on Twitter: "@HallDazia If you need help with your W2, please call HR4U at 888-431-4748 -JS" / Twitter.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find humana workday login?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific humana employee login and other forms. Find the template you need and change it using powerful tools.

How do I make changes in humana human resources phone number?

With pdfFiller, it's easy to make changes. Open your humana in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit my2 humana on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as myhumana. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is GN-99955-CG?

GN-99955-CG is a specific form used for reporting certain financial or regulatory information as required by a governing body.

Who is required to file GN-99955-CG?

Entities or individuals who meet specific criteria set forth by the governing body, typically related to financial reporting or compliance, are required to file GN-99955-CG.

How to fill out GN-99955-CG?

To fill out GN-99955-CG, follow the instructions provided on the form, ensuring all required fields are completed accurately, and include any necessary supporting documentation.

What is the purpose of GN-99955-CG?

The purpose of GN-99955-CG is to collect necessary information for compliance monitoring, reporting, or assessment by the governing body.

What information must be reported on GN-99955-CG?

The form typically requires reporting financial data, personal or entity information, compliance status, and any other relevant details as specified in the form instructions.

Fill out your GN-99955-CG online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

my2 Humana Com is not the form you're looking for?Search for another form here.

Keywords relevant to 8884314748

Related to 888 431 4748

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.